Multifamily Real Estate Financing

Multifamily Real Estate Financing

Multifamily Financing Real Estate Loans

Purchase or refinance with confidence—you’re getting competitive rates, no points, no broker fees, and terms that are flexible for your needs.

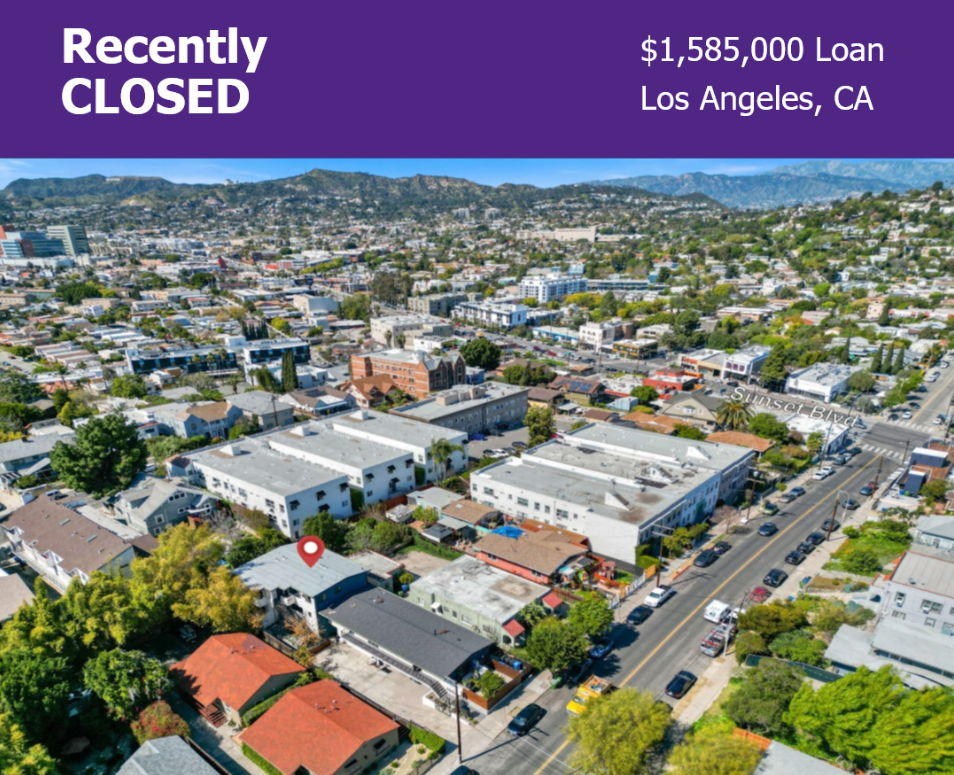

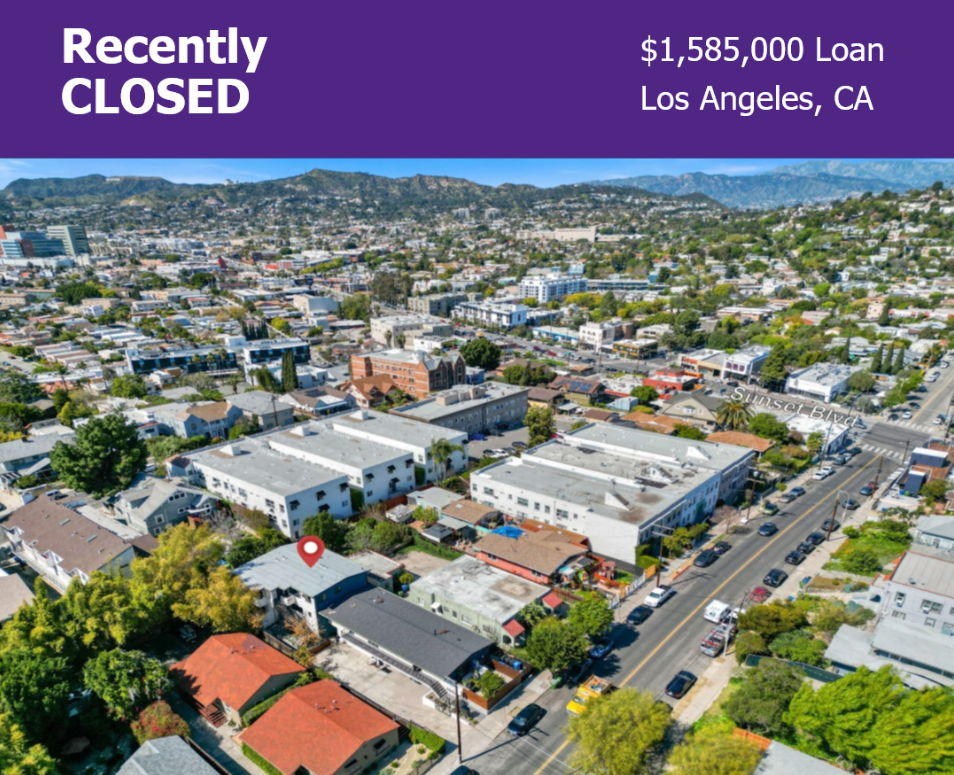

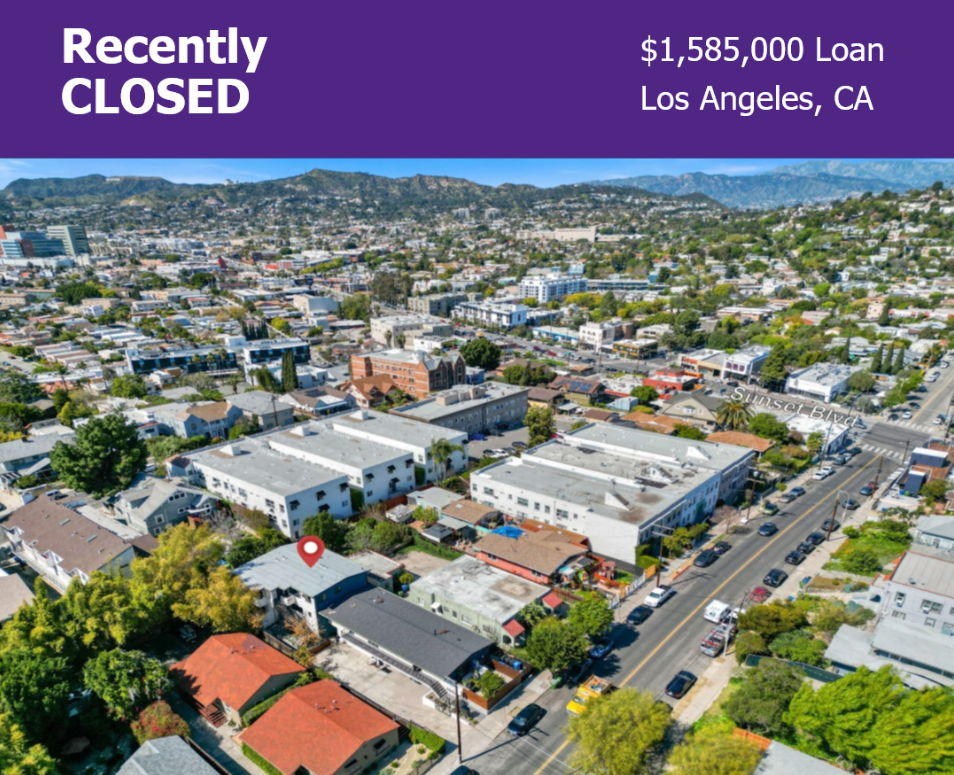

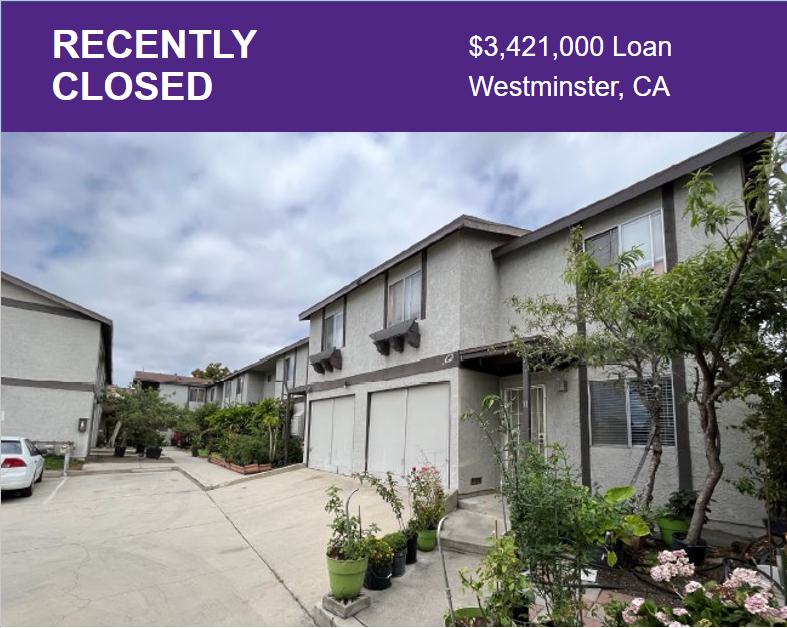

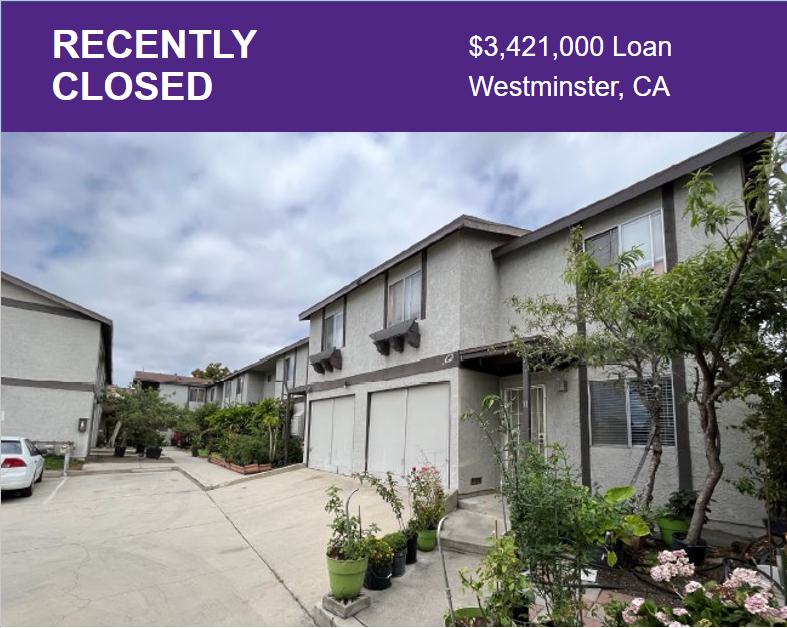

Multifamily Real Estate Loans Recently Closed by Orange County's Credit Union

What's Needed

We can help you expand your portfolio and ensure you're getting the best rate and terms. Start your multifamily real estate loan application today.

Important Documents You'll Need |

Loan Qualification Reminders |

|

|

Submit your files and we'll get started with your multifamily real esate loan request.

Important Documents You'll Need

- Credit Application

- Form 4506-C: IVES Request for Transcript of Tax Return

- Personal Financial Statement

- Business Debt Schedule

(.xlsx File Download)

Loan Qualification Reminders

- 680 Minimum FICO

- DSCR minimum 1.20-1.25xs

- Property Located in Orange County, Riverside County, San Bernardino County, or Los Angeles County

- Cash Out Must be for Business Use

- Loan Amounts Range from $500,000 up to $7,500,000

- Full Recourse

- 2 Years Tax Returns Required

Submit your files and we'll get started with your multifamily real esate loan request.

Meet Your Loan Consultants

Ben Newman

Senior Commercial Real Estate Loan Officer

(714) 755-5900 ext. 7436

bnewman@orangecountyscu.org

Ben Newman is the Senior Commercial Real Estate Loan Officer at Orange County’s Credit Union. Having started his banking and finance career while still attending university and quickly becoming a licensed loan officer in 2004, Ben soon learned that he had the aptitude and passion to navigate the unique Southern California commercial real estate market. Fast forward two decades and Ben has completed over $1 billion in loan transactions, refined his keen insight into the nuances of commercial loan timing and structure, and become a trusted professional known to maximize client savings, convenience, and, ultimately, client satisfaction.

His clientele ranges from high-net-worth individuals and influential property owners/developers, to family teams and first-time investors. Arranging multifamily, industrial, retail, office, and self-storage loans, among others, has given Ben the perspective and experience to bring those he serves significant savings and investment profitability. Having experienced Ben’s signature service and personal touch, his clients return time and time again, with many having expanded their portfolios to include additional revenue sources such as construction financing, bridge loans, and permanent loans.

Ben is proud to be an Anteater, having attended his hometown University of California Irvine on an academic scholarship and graduating in 2007 with his Bachelor of Science degree in Criminology, Law, and Society. When he is not delivering excellent service and value to his Credit Union clients, you can find Ben fishing with his son, watching an action film with his wife, or regularly volunteering at any number of financial literacy events for at-risk youth.

Art Armas

SVP Commercial Services

(714) 755-5900 ext. 7438

aarmas@orangecountyscu.org

With over 20 years in the financial services sector, Armas has held a number of both commercial and consumer lending positions. Having been a Member of Orange County’s Credit Union since the age of 16, Armas had experienced firsthand the values and customer loyalty the Credit Union prides itself on delivering to its Members. When it came time to make a pivotal, career-defining move, Orange County’s Credit Union was a natural progression combining both his financial expertise and visionary spirit with the Credit Union’s Putting People Before Profits mission.

Armas holds both a graduate-level Certificate in Business Banking and a Leadership Certificate from the Foster School of Business at the University of Washington.

Ben Newman

Senior Commercial Real Estate Loan Officer

(714) 755-5900 ext. 7436

bnewman@orangecountyscu.org

Ben Newman is the Senior Commercial Real Estate Loan Officer at Orange County’s Credit Union. Having started his banking and finance career while still attending university and quickly becoming a licensed loan officer in 2004, Ben soon learned that he had the aptitude and passion to navigate the unique Southern California commercial real estate market. Fast forward two decades and Ben has completed over $1 billion in loan transactions, refined his keen insight into the nuances of commercial loan timing and structure, and become a trusted professional known to maximize client savings, convenience, and, ultimately, client satisfaction.

His clientele ranges from high-net-worth individuals and influential property owners/developers, to family teams and first-time investors. Arranging multifamily, industrial, retail, office, and self-storage loans, among others, has given Ben the perspective and experience to bring those he serves significant savings and investment profitability. Having experienced Ben’s signature service and personal touch, his clients return time and time again, with many having expanded their portfolios to include additional revenue sources such as construction financing, bridge loans, and permanent loans.

Ben is proud to be an Anteater, having attended his hometown University of California Irvine on an academic scholarship and graduating in 2007 with his Bachelor of Science degree in Criminology, Law, and Society. When he is not delivering excellent service and value to his Credit Union clients, you can find Ben fishing with his son, watching an action film with his wife, or regularly volunteering at any number of financial literacy events for at-risk youth.

Art Armas

SVP Commercial Services

(714) 755-5900 ext. 7438

aarmas@orangecountyscu.org

With over 20 years in the financial services sector, Armas has held a number of both commercial and consumer lending positions. Having been a Member of Orange County’s Credit Union since the age of 16, Armas had experienced firsthand the values and customer loyalty the Credit Union prides itself on delivering to its Members. When it came time to make a pivotal, career-defining move, Orange County’s Credit Union was a natural progression combining both his financial expertise and visionary spirit with the Credit Union’s Putting People Before Profits mission.

Armas holds both a graduate-level Certificate in Business Banking and a Leadership Certificate from the Foster School of Business at the University of Washington.

View Our Full Commercial Services Offering

Business Banking Products |

|

» |

Business Checking |

» |

Business Savings |

» |

Business Money Market |

» |

Business CD's |

Business Loan Products |

|

» |

Business Vehicle Loans |

|

|

|

|

|

|

|

|

|

Commercial Real Estate |

|

» |

Commercial Real Estate Financing |

» |

Multifamily Real Estate Financing |

|

|

|

|

|

|

Business Banking Products |

|

» |

Business Checking |

» |

Business Savings |

» |

Business Money Market |

» |

Business CD's |

Business Loan Products |

|

» |

Business Vehicle Loans |

|

|

|

|

|

|

|

|

|

Commercial Real Estate |

|

» |

Commercial Real Estate Financing |

» |

Multifamily Real Estate Financing |

|

|

|

|

|

|