Apply for a Home Loan Without the Down Payment*

One of the most significant obstacles to homeownership is a lack of cash to pay for the down payment and closing costs. Our Zero Down Adjustable-Rate Mortgage (ARM) Loan can help you purchase a home with no down payment and a fixed rate for the first 5, 7, or 10 years (may vary after the initial period), so you can enjoy lower interest rates, have a chance to own property, and start building equity.

|

|

|

- Available for Conforming and Jumbo loan amounts1

- No maximum income limitations

- For first-time and seasoned buyers

- Lower Mortgage Insurance coverage required, meaning lower monthly housing payments

- No increased loan fees or higher loan rates

- No-points option

- No pre-payment penalty or negative amortization

- No upfront fees

- Interest may be tax-deductible2

- Available for Conforming and Jumbo loan amounts1

- No maximum income limitations

- For first-time and seasoned buyers

- Lower Mortgage Insurance coverage required, meaning lower monthly housing payments

- No increased loan fees or higher loan rates

- Enhanced Debt-to-Income ratio requirements to help you qualify for a larger loan amount

- No-points option

- No pre-payment penalty or negative amortization

- No upfront fees

- Interest may be tax-deductible2

97% Loan Comparison

Conventional97% Loan |

Orange County'sCredit Union 97% Loan |

|

|---|---|---|

| Purchase Price | $500,000 | $500,000 |

| Down Payment % | 3% | 3% |

| Down Payment $ | $15,000 | $15,000 |

| Loan Amount | $485,000 | $485,000 |

| Borrower Credit Score | 700 | 700 |

| Loan Program | 7/1 ARM | 7/1 ARM |

| Interest Rate* | 6.875% | 6.375% |

| APR* | 8.042% | 7.333% |

| Loan Payment (Monthly) | $3,186.10 | $3,025.77 |

| PMI Premium | 1.28% | 0.70% |

| PMI Payment (Monthly) | $517.33 | $282.92 |

| Property Taxes (Monthly) | $520.83 | $520.83 |

| Property Insurance (Monthly) | $137.50 | $137.50 |

| Total Housing Payment (Monthly) | $4,361.77 | $3,967.02 |

*Rate/APR Comparison Date 08/26/2024. Adjustable rates are subject to change and may go up. ZIP Code: 92705

Monthly Savings |

$395 |

$395 Monthly Savings |

Annual Savings |

$4,737 |

|

Savings Over 10 Years |

$47,369 |

97% Loan Comparison

|

Conventional 97% Loan |

Orange County's Credit Union 97% Loan |

|

|---|---|---|

| Purchase Price | $500,000 | $500,000 |

| Down Payment % | 3% | 3% |

| Down Payment $ | $15,000 | $15,000 |

| Loan Amount | $485,000 | $485,000 |

| Borrower Credit Score | 700 | 700 |

| Loan Program | 7/1 ARM | 7/1 ARM |

| Interest Rate* | 6.875% | 6.375% |

| APR* | 8.042% | 7.333% |

| Loan Payment (Monthly) | $3,186.10 | $3,025.77 |

| PMI Premium | 1.28% | 0.70% |

| PMI Payment (Monthly) | $517.33 | $282.92 |

| Property Taxes (Monthly) | $520.83 | $520.83 |

| Property Insurance (Monthly) | $137.50 | $137.50 |

| Total Housing Payment (Monthly) | $4,361.77 | $3,967.02 |

*Rate/APR Comparison Date 08/26/2024. Adjustable rates are subject to change and may go up. ZIP Code: 92705

Monthly Savings |

$395 |

Annual Savings |

$4,737 |

Savings Over 10 Years |

$47,369 |

|

$395 Monthly Savings |

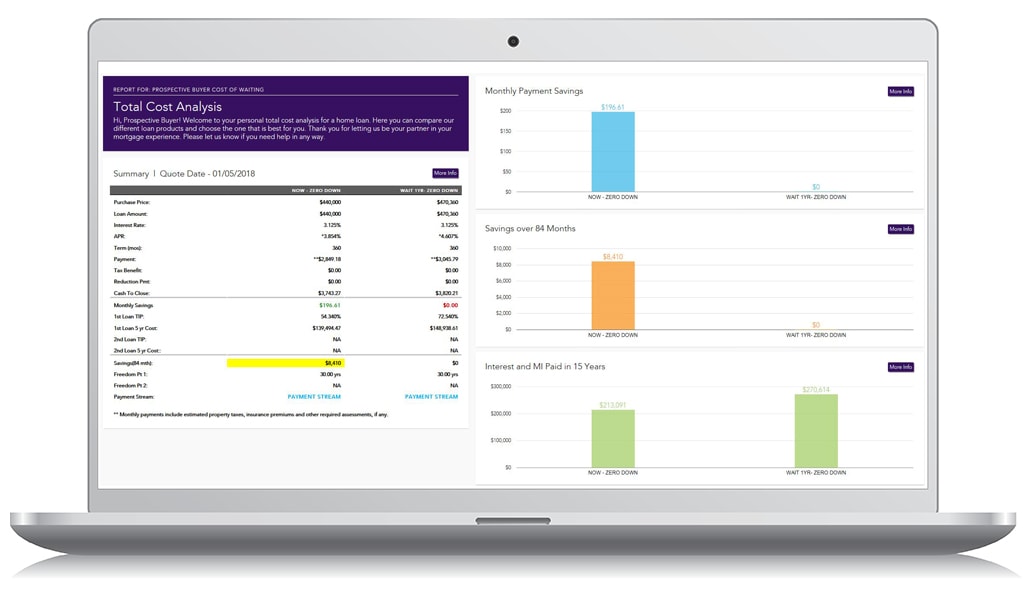

You also have access to our complimentary Total Cost Analysis, designed to give you a side-by-side comparison of your loan options, costs, and savings. Be sure to ask about our Rent versus Own and Cost of Waiting Analysis.

Get started! Call (800) 506-5070 or click below to receive a call back at your convenience.

You’re sure to have lots of questions. Our Mortgage Loan Consultants will work with you to determine the right loan, to lock in the best interest rate, and to make your loan process as easy as possible. They’ll do all of the application paperwork on your behalf and provide advice each step of the way.

Borrower’s Tip: Sign up for our Home Connections program. Receive one-on-one guidance from a local experienced real estate agent and a commission rebate that may be used toward your closing costs.³

*Rate Assumptions

Rate and APR: Interest rates and annual percentage rates (APRs) are based on current market rates, are for informational purpose only, and are subject to change without notice. They may be subject to pricing variations related to property type, loan amount, loan-to-value, credit score, refinance with cash out and other variables—call for details. Property must be located in California. We based the mortgage interest rates shown on a 30-day rate lock period. This is not an offer for an extension of credit or a commitment to lend. All applications are subject to borrower and property underwriting approval. Not all applicants will qualify. APR reflects the effective cost of your loan on a yearly basis, taking into account such items as interest, most closing costs, discount points (also referred to as “points”) and loan origination fees.

Points: An amount paid to the lender in order to lower the interest rate. Also known as discount points. One point equals one percent of the loan amount (for example, 1 point on a $100,000 mortgage would equal $1,000).

Payment: This is the total estimated dollar amount you will be expected to pay every month. It consists of Principal & Interest which is what you will pay to repay the amount you borrowed, and the interest that has accrued on that amount over the last month. The payment displayed does not include amounts for hazard insurance or property taxes, which will result in a higher actual monthly payment. If you have an adjustable-rate loan (ARM), your monthly payment may change annually (after the initial period) based on any increase or decrease in the index.

Chart data is for illustrative purposes only and is subject to change without notice. Advertised APR is based on a set of loan assumptions that include a borrower with excellent credit (700 credit score or higher), a loan amount of $485,000, a loan to value (LTV) of 97% or less, a one unit property that is a primary residence, and the loan purpose is a purchase or a rate and term refinance. Your actual APR may differ depending on your credit history and loan characteristics. Accuracy is not guaranteed and products may not be available for your situation. ARM interest rates and payments are subject to increase after the initial fixed-rate period (5 years for a 5/1 ARM, 7 years for a 7/1 ARM and 10 years for a 10/1 ARM).

For more information/disclosures about ARM programs:

¹The maximum loan amount is available in high-cost areas; not to exceed the high-cost conforming loan limit for that area. For non-high-cost areas, the maximum loan amount is $1,000,000. Ask your Mortgage Loan Consultant about conforming loan limits in your area.

²For information regarding specific tax qualifications, please consult a tax advisor.

³Rebate is awarded by HomeSmart Evergreen Realty to buyers who select and use a real estate agent in the Home Rewards network. Rebate is 20% for purchase only of a residential property. Payment is credited to your benefit at the close of transaction. Using Orange County’s Credit Union for a mortgage loan is not a requirement to earn the rebate. All rebates are subject to limitations, lender guidelines, state laws and other requirements. Certain properties may not be eligible for rebates. Please consult a qualified tax professional for advice on tax implications from receiving a rebate. HomeSmart Evergreen Realty is not affiliated with Orange County’s Credit Union.